Job Growth Decelerated as COVID Surged and UI Benefits Expired

August 2021 BLS Jobs Report Analysis

Although the economy added jobs throughout the month of August, the overall pace drastically decreased as new COVID-19 cases surged. Only a few years ago, a BLS jobs report showing a net increase of 235,000 jobs would have been relatively strong growth.

But with an economy still recovering from the millions of jobs lost throughout 2020, and July’s numbers being revised up to over a million jobs added just one month before, this is hardly good news. It wasn’t necessarily unexpected, as I noted in last month’s article, but it is disappointing, nonetheless.

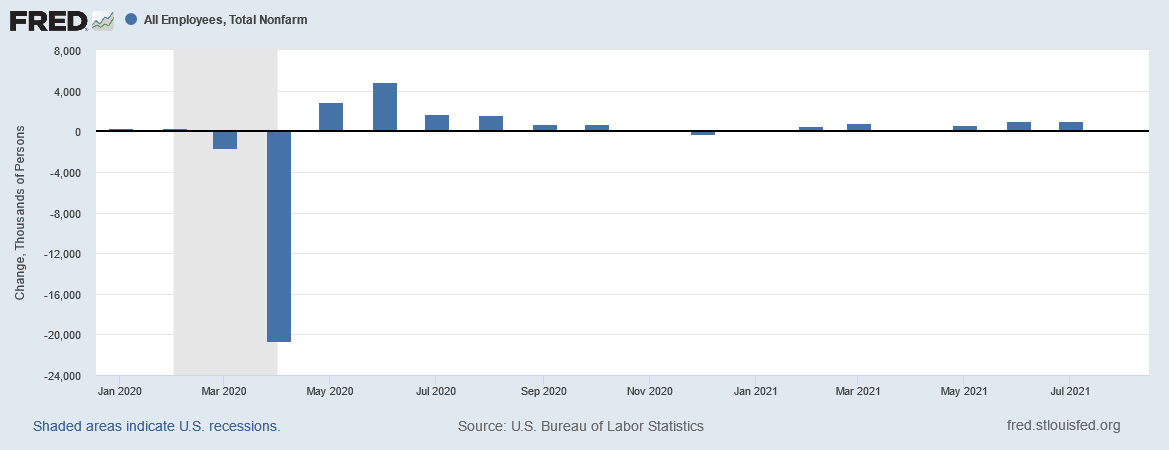

To put these jobs numbers into context, we are once again at a point where August’s jobs are hardly visible when put on a single graph whose scale is distorted by the roughly 20 million jobs lost in April 2020.

Because of the slowing job growth throughout August, as you will see later in the article, the three-month trend in jobs added declined for the first time this year. But before we get to the broader trends, let’s take a closer look at the month of August.

August 2021 Jobs Report

Filtering out 2020 jobs numbers and focusing on 2021, you can once again see how August compares to other months this year.

As of current revisions, this marks August as the second worst month for net job growth in 2021, and it only beats January by roughly 2,000 jobs. Just as the economy slowed and even lost jobs in December 2020, during the third wave of Coronavirus cases, August’s jobs numbers correlate with the fourth wave, as you can see in the CDC chart below.

Thankfully, the nation appears to be turning a corner in September, since new COVID cases are on a downward trend for the first time in months, but the future remains uncertain.

Some of the effects of surging Coronavirus cases are already apparent in the table below, which breaks down employment numbers into various industries.

Beyond the stark contrast in figures along the top line, industries like the leisure and hospitality industry show a huge difference between the August and July columns. July showed leisure and hospitality adding 415,000 jobs – and the BLS notes that the industry was averaging roughly 350,000 jobs added for the prior six months – but then throughout August, the industry’s growth fell flat. It added zero jobs.

Just as the leisure and hospitality industry was among the hardest hit early in the pandemic, and often tops the charts when COVID cases are subsiding, it also appears to be once again bearing the brunt of a resurgence in Coronavirus cases. Digging further into the details, food service and drinking establishments led the losses in the industry, while job growth in arts, entertainment, and recreation jobs mitigated these losses.

It’s an odd divergence where, despite this fourth wave of COVID cases, people are still willing to take some risks but not others. Perhaps some activities are easier to do outdoors, even if it also involves a risk of being in crowds of people. There is also something to be said about “safety fatigue” from having to take pandemic precautions for so long.

I could speculate about other possible explanations, but economists are also puzzled. I recently listened to an episode of Marketplace which included an interview with an economist who works at Indeed. Part of that interview examined the puzzling discrepancy.

“We actually did see a fairly decent pickup in an industry called amusements, gambling and recreation,” said Nick Bunker, an economist with the job site Indeed.

The leisure side of hospitality and leisure picked up 30,000 jobs in August: take casino workers, or those teenagers you reluctantly trust to strap you in on a Six Flags rollercoaster. It’s a weird circle to square. People willing to go to Disneyland, but not the restaurant down the street?

“There may be lots more people saying ‘I definitely need to take a vacation this summer.’ Maybe people who didn’t change their plans according to that,” Bunker said.

So, while the leisure and hospitality neither experienced a net gain nor a net loss in jobs – because different subsets of that industry gained jobs while others lost them – the industry which led job gains in prior months remained flat throughout August.

Due to reasons which I suspect are similarly driving losses in parts of the leisure and hospitality industry, the retail industry lost approximately 28,500 jobs. Most of these losses were in the “food and beverage stores” subset of the retail industry. Retail lost more jobs than any other industry, but several industries lost at least a few thousand jobs throughout August. Another sector which suffered losses, despite fairly strong growth in prior months, was in government jobs. Many of these government jobs lost since the pandemic began are in education.

The construction industry also lost jobs despite gaining jobs in July. Meanwhile, Senator Joe Manchin resumed obstructing our infrastructure investment bills, along with every single Republican member of Congress, even though these bills would create millions of jobs over the next decade.

Despite these losses, the broader economy still added jobs overall, leading to a lower topline unemployment rate. However, just like we discussed last month, the topline alone does not paint a complete picture of what working families experience.

Disaggregated Statistics Revisited

Once topline statistics are broken down, or disaggregated, into different demographic groups, you often find different groups are disproportionately impacted by the pandemic. I wrote about this concept more broadly in my article analyzing the July jobs report, but due to the ongoing fourth wave of COVID cases, I want to revisit these concepts. August 2021 highlighted these disparate impacts in predictable, if unfortunate, ways.

For instance, although the official unemployment rate declined, and did so for most racial groups, Black or African American workers’ unemployment rate increased throughout August. The official rate declined from 5.4% down to 5.2%, but as you can see in the graph below, the unemployment rate for Black workers rose by 0.6% up to 8.8%.

The blue line representing the Black or African American unemployment rate, is the only line which takes a rather sharp turn upwards, while the others showed slight declines.

Another noteworthy but unfortunate statistic, which is only revealed when taking a closer look at the data, relates to the disparate impact this month had on men and women. Although there were 235,000 jobs added to the economy, only approximately 28,000 of those jobs went to women.

This means that only 11.9% of all the jobs added last month went to women, while roughly 88.1% of them went to men.

For any readers who are interested in seeing more of the breakdown in various industries, and how many women are employed in such industries – both in total numbers and as a percentage of the total – you can see the detail in the table below.

Just as we observed when looking back at the first wave of the pandemic, women are often disproportionately impacted by COVID cases surging, and this frequently relates to the industries in which they are employed. Note, for example, that although women make up less than half of all workers, they represent the majority of workers in the leisure and hospitality industry.

Women also disproportionately hold jobs in the field of education. Referring once again to the table above, women hold 77% of all jobs in the private sector’s education and health services industry. They also hold nearly 58% of government jobs, which includes state and local government education positions. Although private educational services added jobs throughout August, state and local education jobs drove losses in government jobs. Most of the job losses in the private education and health industry were attributable to health care, child care, and nursing losses.

Because topline statistics don’t always paint a full picture, similar considerations need to be kept in mind when examining the disparate impact the pandemic has on people of color.

With so many industries ostensibly impacted by the worsening pandemic – which I hope and pray may soon be better contained, especially with winter right around the corner – I wanted to discuss some pandemic-specific statistics. The BLS started keeping track of additional data last year to help examine how the pandemic impacts workers and businesses across the country.

Pandemic-Specific Data

While some information about the pandemic’s impact can be inferred from longstanding questions in BLS surveys, they also started adding new questions to the surveys in May 2020. Examples include questions relating to telework, or working from home, due to the pandemic; having reduced hours or being unable to work altogether due to businesses closing; and being unable to look for work, despite wanting to do so, due to the pandemic.

Throughout August, many of these data points worsened. 5.6 million people were reportedly unable to work due to their employer either closing completely or losing business due to the pandemic, which is roughly 400,000 more than the month before. Of those who were unable to work, only 13.9% – or about 778,400 people – were paid by their employer; many may not have even received the full amount of pay they had to forgo, either. Because of the pandemic specifically, 13.4% of employed people teleworked. Among those who did not have a job, but would otherwise want to look for employment, 1.5 million people were unable to look for work due to the pandemic.

While some of these figures are worse than the prior month, they are better than they were as the third wave of new COVID cases was reaching its peak. In December 2020, 15.8 million people were unable to work due to the pandemic; 27.3% of the workforce teleworked; 4.6 million unemployed people were unable to seek employment. Our situation is not as dire as it was during last winter, but there are still many metrics moving in the wrong direction.

Thankfully, President Biden announced new pandemic-related workplace safety requirements on September 9, 2021. Among these new requirements are mandates for federal employees to be vaccinated, and for employers with more than 100 employees to ensure that their workers are either vaccinated or submit a negative COVID test every week.

Personally, I wish these requirements had been enacted months ago, or at least something similar until vaccines received full FDA approval, but this is better late than never. It is important for us to remain proactive in taking precautions against the pandemic worsening.

Despite decelerating job growth in August, which I suspect is due primarily to a surge in COVID cases throughout the month, it is important to pay attention to broader trends and to not read too much into any single month’s data.

Three-Month Trends

For the first month this year, the average rate of job growth declined. Over the past three months, total nonfarm employment averaged 750,000 jobs added per month, which is down from a revised 876,000 jobs last month. You can see the current averages and how they line up with the averages calculated last month in the graph below.

As mentioned previously, July’s job growth numbers were revised to roughly 1.05 million, so its three-month average calculated in the latest jobs report – represented by the middle blue bar on the graph above – is quite a bit higher than previously estimated. It makes the contrast between last month’s three-month average and August’s average even more apparent. However, because August’s three-month average is bolstered by strong growth in June and July, September’s three-month average could likewise decline unless we get the pandemic under control.

Despite slowing growth, most industries have been showing growth or holding steady. You can see the three-month totals in the chart below, where most of the data points are sitting on, or to the right of, the line marked “0”.

The economy is recovering, despite troubling signs of slowing growth, but it has not yet recovered. Neither the economy nor working families have recovered from the pandemic. It is important to keep this in mind, so I want to briefly reflect on data highlighting how far we still have to go.

Pandemic UI Benefits Expired Despite Incomplete Economic Recovery

I worried about such an outcome ever since the American Rescue Plan extended certain unemployment insurance (UI) benefits until September 6, 2021 – Labor Day.

The federal UI programs which expired on Monday were the Pandemic Unemployment Assistance (PUA) and Pandemic Emergency Unemployment Compensation (PEUC) programs. According to the latest Department of Labor Unemployment Insurance Weekly Claims News Release, nearly 5.1 million people were still filing continued claims for the PUA program, and the PEUC had over 3.8 million people as of August 21, 2021.

This means that roughly 8.9 million people lost these benefits on Labor Day. As discussed previously, preliminary data suggests that the Republican governors who tried to end these programs early only caused unnecessary hardships; I doubt this will be any different.

A cornerstone of our expanded social safety net – which is largely in shambles, and arguably had to be expanded just to be a minimally viable program during this unprecedented crisis – gave way on an arbitrarily set expiration date when neither the economy nor working families have recovered.

Several economic indicators highlight these unfortunate circumstances and just how far we have to go, despite significant progress. The most obvious statistic is that there are still 8.4 million people unemployed, which is 5.7 million more people than were unemployed before the pandemic. This does not even paint a full picture of the number of people still recovering from the economic harm caused by the pandemic, as the Economic Policy Institute pointed out in the infographic below.

You can see the 8.4 million officially unemployed, but another group we’ve discussed multiple times is the people who have dropped out of the labor force. The 4.2 million who dropped out of the labor force is based on the assumption that, if the labor force had continued growing without pandemic disruptions, we would be approaching 166 million people, but instead we are at just above 161.5 million people in the labor force as of August.

Using methods outlined in a prior EPI article, they also estimate 3.2 million unemployed people may be misclassified, and that roughly 3 million people who are still employed are working fewer hours and for less pay. In total, that leaves at least 18.7 million workers still recovering from the impact of the pandemic.

But what about the record 10.9 million job openings the latest Job Openings and Labor Turnover Survey (JOLTS) reported? Surely, if the 8.4 million unemployed people simply filled these job openings, then the problem would be solved, right?

The short answer is no.

First, you need to examine which industries have these job openings. Education and health services has the highest total openings at nearly 2 million, 90% of which are classified under the “health care and social assistance” segment of the industry.

The industry with the highest rate of job openings, leisure and hospitality, is not far from that total either. It reported over 1.8 million job openings, with roughly 87% of those being in the “accommodation and food services” segment. The accommodation and food services industry has an opening rate of 10.8% of all jobs, the highest of any industry. Perhaps there is a reason these industries have the highest total and percentage of job openings, respectively, such as – I don’t know – how they’re impacted by the pandemic!

Beyond job openings, there is also a second part of the JOLTS data to consider: the labor turnover. As it turns out, the industry with the highest rate of job openings also has the highest rate of people quitting their jobs. The accommodation and food services subset of the leisure and hospitality industry accounted for 710,000 quits, a rate of 5.4% of all jobs in the industry, and 91% of all quits in the broader leisure and hospitality industry. Health care and social assistance had 516,000 quits.

There are other factors, of course – and I may further examine certain details in a future article – but don’t allow reductive arguments, which often focus solely on the number of job openings, to diminish the severity of systemic deficiencies workers constantly face. Many of these jobs remain open for a reason.

Perhaps if our healthcare workers weren’t so overwhelmed, our restaurant workers and other essential workers had better work conditions, better pay, and they weren’t treated like disposable cogs in a machine, there wouldn’t be so many job openings and people quitting their jobs. As several studies indicate, we would also be better off as a society if all workers were treated with dignity.

Until then, I remain convinced that the best way to bring about these changes is through compassion, solidarity, and unionization.

Thank you for reading my newsletter and taking the effort to learn about making the world a better place. I look forward to hearing your thoughts on how we can make progress towards a more just economy.

-JJ

Updated 6/27/2022 - Updated captions for graphs and tables

Updated 10/7/2021 - Added caption to three-month average graph.

Updated 9/21/2021 - Added buttons throughout; italicized sign-off paragraph.