The American Rescue Plan and Maintaining Momentum

Coronavirus Relief and Economic Stimulus Vol. III

Welcome to the first issue of the Economic Justice and Progress Newsletter in which I may finally report on a new $1.9 trillion Coronavirus relief bill passed by a new Congress with the guidance of, and signed into law by, a new Administration in the White House. I presented arguments throughout my previous article in this series advocating for Congress and President Biden to “be bold in a way not seen since FDR in the 1930s”, like Senator Bernie Sanders encouraged, and while I will contend that the American Rescue Plan is a great step in the right direction, we have a long way to go before we reach the levels of fundamentally transformative legislation delivered by FDR’s New Deal.

This legislative step in the right direction may yet prove to be a pivotal moment in American politics where we begin to abandon the Reagan-Thatcher neoliberal philosophy of governments essentially existing for the sole purpose of subsidizing massive multinational corporations. The federal government may instead end its decades-long abdication of its Constitutional obligation to “promote the general Welfare” and enact policies which help alleviate unnecessary suffering amongst the general public. However, bringing about transformative legislation which addresses systemic issues causing or exacerbating such unnecessary suffering will require maintaining the political momentum from this moment in order to deliver further progress.

Despite the many concessions and compromises made to decrease the size and scope of the bill, not a single Republican voted for the bill, so every single accomplishment—and, unfortunately, every unforced error—is entirely attributable to the Democratic party. Still, the Democratic party has largely learned from lessons of past mistakes, and this bill repeats many of the successes within the CARES Act, so let’s examine what relief is on the way and which provisions did not remain in the final bill.

Core Economic Relief Provisions, Compromises and Concessions

Like 2020’s Coronavirus relief bills, the American Rescue Plan Act of 2021 essentially contained several individual spending bills which were signed into law within the one Act. Because the pandemic has devastated so many different sectors of the economy and so many people in different ways, the economic policy prescriptions had to be commensurately multifaceted to effectively address the many problems caused and worsened by COVID-19.

An excellent summary going through the 242-page bill title by title is available on the Senate website—which I will refer to multiple times throughout this article as the “Senate Summary”—and the summary also helps provide economic context and the general reasoning behind including certain items. After examining such details, and as we discuss the bill’s key inclusions throughout this article, you will notice that many of the core provisions in this relief package are similar to those in the CARES Act, though certain specifics changed this time.

Unfortunately, the $1.9 trillion price tag was written into the rules of budget reconciliation governing the passage of this bill, despite most experts agreeing that economic relief risks being too small rather than too large, as we discussed previously. This meant that many successes introduced came at the cost of cuts from other types of spending or tax cuts. I want to focus on certain core provisions which made it into the final bill, what did not make the final cut, and what compromises were made as a result of certain cuts from the original proposal.

As we examine the cuts from the original proposal, we should keep two questions in mind: first, what was gained from making this concession? And secondly, should Biden have asked for more from the beginning?

Disclaimer

Before we get into the specifics, I want to remind readers that this article and others in the Economic Justice and Progress Newsletter are written for educational and editorial purposes, and should not be considered accounting, tax, financial, or legal advice. Furthermore, I only briefly discuss general provisions, so please ask your tax professional or use authoritative sources like the IRS website for more information before making any decisions impacted by this type of information.

Summary

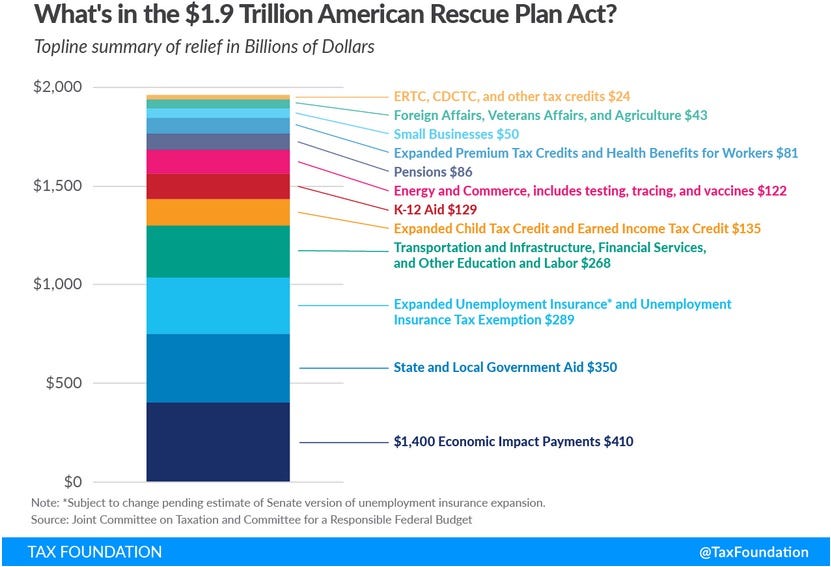

The Tax Foundation, a nonprofit tax policy organization, prepared a helpful breakdown estimating the cost of each spending category making up the $1.9 trillion in total spending, measured in billions of dollars, which you can see in the chart below:

With the above breakdown in mind, this article explores details surrounding the following provisions in the American Rescue Plan:

Economic Impact Payments – Up to $1,400 per person

Additional federal unemployment insurance benefits – $300 per week

Tax credits and other changes to the tax code

A notable exclusion – the $15 per hour federal minimum wage did not pass

Funding for SNAP and other nutritional programs

Food supply chain support and anti-discrimination measures for farmers of color

Housing assistance

Small business, restaurant, and entertainment venue relief

Multiemployer pension grants

Healthcare and pandemic-specific provisions

Foreign aid

Consumer product, school reopening, and workplace safety funding

Broadband and transportation infrastructure

Federal, State and local government funding

Outreach and oversight funding

After covering the contents of the American Rescue Plan, I also briefly discuss an interesting report analyzing who benefits from the legislation, and I conclude by addressing the political path forward and the need to maintain momentum, lest this remains the only meaningful legislation of the Biden presidency. Feel free to skip around to the sections that most interest you, but I will begin by discussing the $1,400 Economic Impact Payments.

Economic Impact Payments – Up to $1,400

The provision affecting the broadest groups of working families is the $1,400 relief checks for not only every adult making under $75,000 per year, but additionally all dependents in their household. Unlike the CARES Act and the December 2020 relief bill, this also includes adult dependents. However, the phaseouts for households with incomes above $75,000 are much steeper than before, so that individuals earning $80,000 or more, and couples filing jointly who earned $160,000 or more, will not receive any benefits.

Previously, benefits phased out at $100,000 for individuals and $200,000 for couples; lowering the threshold by $20,000 per person leaves out at least 6.5 million households who received Coronavirus relief checks under Trump. Although this means that Biden did not deliver the full $2,000 he repeatedly promised, it does mean that certain individuals who previously received nothing are now included.

Ideally, everyone who received benefits under Trump would have received $2,000 or more from the Biden administration, both for beneficial economic relief and for clear political messaging. However, corporate Democrats like West Virginia Senator Joe Manchin spent the past few months arguing against additional relief, and ended up being instrumental in denying relief to working families due to his disproportionate influence over the 50-50 Senate, where a single Democratic vote can doom legislation.

Perhaps the rest of the Democratic party felt pressured to cut a suboptimal deal quickly rather than engage in lengthy negotiations, since the December 2020 relief package included a (frankly unnecessary) expiration date on federal unemployment benefits in mid-March 2021, just days after the American Rescue Plan passed. Regardless, the Senate recessed for an entire week after failing to convict former President Trump in his second impeachment trial, so they bear responsibility for both the looming expiration on UI benefits and for waiting until practically the last minute.

It is also disappointing that even with these concessions and other cuts to the original proposal, President Biden—the Senate veteran with decades of experience, and supposed bipartisan dealmaker—could not get a single Republican’s support and even struggled to secure all Democratic Senators’ votes for his agenda. This further confirms my suspicion that Republican politicians are uninterested in bipartisan compromise, and seek only to obstruct successful legislation supported by Democratic and Republican voters alike, if doing so would allow them to later campaign on Democrats being ineffectual. Rather than trying to appease Republican politicians who will never vote for progressive Democratic legislation, more effort should be spent ensuring that Democrats who neither lead with their own ideas, nor follow the overwhelmingly popular party platform, will expect a primary election challenge in the near future.

Although including adult dependents in Economic Impact Payment disbursements is an important gain, perhaps Biden should have asked for more initially. That way, if Biden began negotiations at, say, $2,000 checks for everyone who received $600 last time, but he still found concessions to be politically necessary, perhaps the compromise would then involve reducing $2,000 checks down to $1,400. If asking for more initially meant that middle-class families would still have also been included in this round of relief checks, perhaps the economic and political damage dealt by this compromise would have been avoided.

While this is just hypothetical postulating, and cannot affect the outcome now that all is said and done, denying millions of middle-class families the chance to receive Economic Impact Payments is a completely unforced error that may come back to haunt Democrats during upcoming elections.

Additional Federal Unemployment Insurance Benefits – $300 per Week

President Biden also could not convince enough Senators to support the proposed $400 per week federal unemployment insurance benefits, so we ended up with $300 per week like what passed in December; once again, this is half the amount of weekly UI benefits provided by the CARES Act. I would have supported beginning negotiations at the same $600 per week we passed last March—since economic studies demonstrated the positive benefits it provided last year, and not even this generous amount caused people to decline job offers—and I’m sure the millions of Americans still without jobs would have supported $600 per week as well.

Neither did Biden get the full unemployment benefits he requested, nor will they last as long as Biden proposed. In fact, rather than lasting through September, many of the additional benefits expire on September 6, 2021—Labor Day. Fortunately, despite these concessions, an important tax provision was negotiated: the first $10,200 of unemployment benefits received in 2020 are no longer taxable.

Personally, I think the Reagan-era rule of taxing unemployment benefits should be repealed altogether, but this $10,200 exemption would save struggling families in the 10% tax bracket roughly $1,000. Although an extra $100 of benefits per week would start to outpace this tax deduction after about 10 weeks—depending on the household’s marginal tax rate and other circumstances—handing unexpected tax bills to unemployed workers seems like adding insult to injury. Hopefully alleviating the tax burden will be politically popular enough to offset the economic and political damage caused by compromising on weekly UI benefits.

Enhanced Child Tax Credit – Up to $300 per Month per Qualifying Child

In addition to increased Economic Impact Payments for dependents, the Child Tax Credit (CTC) enhancements included in the American Rescue Plan will help millions of families with children across America. Households with children under 6-years-old receive $3,600 per year or $300 per month, while the parents of older children still under 18 years of age will receive $250 per month. The CTC is also completely refundable for the 2021 tax year, meaning that households expecting a tax refund or those without tax liabilities would also receive benefits, not just households who owe money to the IRS.

These enhancements also provide for the IRS sending out monthly payments rather than making families wait for next year’s tax season to claim their benefits. However, the IRS only has about three months to overcome the many challenges it faces before being able to successfully send out monthly checks to all families who qualify.

Despite potential complications, such changes to the tax code are an excellent step towards a more universal type of child allowance—a permanent monthly payment sent to families across America—but optimistic estimates suggest that even these temporary measures could help cut childhood poverty rates in half. Still, if we can end half of childhood poverty with the stroke of a pen, why not end all of it? And why not end childhood poverty for good, rather than for just one year? Certain esoteric rules surrounding budget reconciliation may have complicated making such provisions permanent, but will we be comfortable essentially doubling childhood poverty after these provisions expire? We must address such questions as we approach midterm elections in 2022.

Other Tax Code Improvements

Many of the provisions in the American Rescue Plan, like some we’ve already discussed, involve changes to the tax code, and several of these changes will make a huge difference for working families. The Child and Dependent Care Tax Credit changes—including making it fully refundable—make it easier for parents to afford childcare while they work. The Earned Income Tax Credit changes also include expanded maximum benefits for households without children, and repeats the CARES Act type of change allowing for 2019 income to be used when calculating benefits if doing so results in a larger credit than using 2021 income would.

Although President Biden has the authority to forgive federal student loan debt, but has only chosen to do so selectively at the time this article was written, this relief package updates the tax code so that student loan debt forgiveness is no longer treated as taxable income. This paves the way for streamlined student debt cancellation across the board without surprise tax liabilities.

Additionally, changes to the Premium Tax Credit make it so that households will not pay any more than 8.5% of their income in health insurance premiums, and households at or below 150% of the poverty line will effectively not pay any healthcare premiums. The new Paid Sick Leave Credit helps employers afford to provide paid time off for sick employees, but it is still a voluntary measure which is not likely to be used by all employers.

While Medicare for All would be preferable to such complicated, technocratic tax policies—and it has the added benefit of facilitating clear political messaging, since “Medicare for All” fits on a bumper sticker much more easily than explanatory paragraphs would—these improvements to the tax code are still important steps towards affordable healthcare, childcare, and education, despite the absence of truly transformative legislation.

Notable Exclusion: The $15 per Hour Minimum Wage Did Not Make the Final Cut

The lack of a $15 per hour minimum wage, even one that gradually phased in over the next four years, was not included in the final American Rescue Plan Act. This was one crucial exclusion that prevented this legislation from being truly transformative. While many opponents of Coronavirus relief bemoaned the near universality of direct relief payments as not being “targeted” enough—since such relief would have helped middle-class families who are apparently not sufficiently economically desperate—targeting relief directly at the people who literally have the lowest legal incomes in this country is also somehow too progressive.

Perhaps most disappointing of all, seven Democrats and one Independent Senator voted against the minimum wage increase. Among the seven Democrats were Joe Manchin, whom we discussed previously, and Kyrsten Sinema, the Arizona Senator who infamously voted “nay” with a flourish and a dramatic thumbs down.

President Joe Biden didn’t exactly fight to convince these Senators, either. During a February interview, Biden basically said that the provision would be dead on arrival, saying that “I put it in, but I don’t think it’s going to survive.” Vice President Harris likewise could have overruled the unelected Senate Parliamentarian on their interpretation of the Byrd Rule, but her refusal to do so added yet another unnecessary hurdle to the minimum wage increase’s inclusion in the budget reconciliation process.

As a result, the federal minimum wage remains $7.25 per hour throughout the country, and many of the most economically vulnerable frontline workers—who are continually told “we’re all in this together”—received neither a pay increase, hazard pay, nor guaranteed paid sick leave after yet another Coronavirus relief bill.

Nutritional Program Funding and Food Supply Chain Provisions

Another set of provisions affecting millions of children and their families is the funding of nutritional programs such as the Supplemental Nutrition Assistance Program (SNAP) and the Special Supplemental Nutrition Program for Women, Infants, and Children (WIC). The Senate Summary cited a disturbing statistic demonstrating the need for such essential programs: “As many as 50 million Americans have struggled to feed themselves or their families during the pandemic and need continued support to put food on the table.” The American Rescue Plan extends many of the increases provided by prior Coronavirus relief bills, but its infrastructural improvements will also likely make SNAP and WIC more accessible to those who need it.

Enhancements to these programs are paired with provisions specific to the food supply chain. The Senate Summary describes funding necessities like purchasing protective equipment for frontline food workers—including farmers and workers in meat processing plants—and providing better food inspection. There are also specific provisions targeting groups disproportionately affected by the pandemic and who have been historically disadvantaged. The Senate Summary provides historical context:

“The Agriculture Department’s lending and financial assistance programs have long discriminated against Black, Indigenous, Hispanic, and other farmers of color. Black farmers in the South alone have lost more than 12 million acres of farmland since the 1950s and many farmers of color who remain in agriculture struggle with burdensome debt that has prevented many from being able to grow and sustain their farms, especially during the pandemic.”

While this certainly cannot erase the lasting harm caused by centuries of unjust, discriminatory exploitation, helping the farmers who feed the world—while also making it easier for struggling families to get the food they need—takes prior successful policies and improves them. Hopefully we will continue to build upon such successes and improve our food supply chain while minimizing food scarcity and injustice.

Housing Assistance

Housing assistance for renters, homeowners, and unhoused people alike is included in various forms throughout the American Rescue Plan. The Senate Summary mentions that the December 2020 relief bill included $25 billion in rental assistance, and that this latest package delivers an additional $21.55 billion, but even this total of $46.55 billion still falls short of the $57 billion in back rent that very same Summary cites as being owed as of January, and April will be upon us soon.

Despite the mounting unpaid rent, the housing provisions in this relief package can help working families get through these trying times. Between the rental relief, mortgage and utility assistance, programs for renting vacant motels and other properties in order to help both unhoused people and business owners at the same time, and other relief provisions, these are all positive inclusions. However, many of these policies are temporary, and addressing skyrocketing rents and systemic problems which lead to homelessness still need to be addressed in future legislation.

Small Business Relief

Several aspects of the American Rescue Plan target small businesses impacted by the pandemic. For example, the Employee Retention Tax Credit helps employers recoup the cost of retaining employees, which could help struggling businesses avoid furloughing their workers.

Certain provisions also specifically target restaurants and entertainment venues with billions in direct relief, including grant and loan programs. Far too many small businesses and venues across the country have closed, some permanently, but these programs can help the small businesses still managing to stay afloat. When it is safe again for such gatherings, I personally cannot wait to go out and listen to live music at a local venue; I hope these relief programs will be sufficiently accessible and substantial enough for these small businesses to make ends meet in the meantime.

Multiemployer Pension Plan Grants

The $86 billion you saw allocated for pensions in the breakdown is for multiemployer pensions, which the Pension Benefit Guaranty Corporation (PBGC) defines as “a collectively bargained plan maintained by more than one employer, usually within the same or related industries, and a labor union.” According to the PBGC website, roughly 10 million people are covered by these multiemployer defined benefit pension plans. If you’ve ever heard of “unfunded liabilities” for pensions in this context, you may also be aware that many unions and other organizations don’t have enough funds set aside to meet all future pension obligations. The American Rescue Plan helps to address such shortfalls by updating certain rules and by providing cash grants for struggling pension funds.

This may help fund these pensions for years, even decades, which is great news for the millions of workers who deserve the pension benefits they earned through hard work and collective bargaining. However, I am unconvinced that such a problem could not arise again once these provisions run out, unless we enact more fundamentally transformative legislation. Pension accounting is rather complicated, and I won’t go into too many details in this article, but let’s just briefly discuss one statistic.

The PBGC Projections Report from 2019 estimated—without accounting for any of the disruptions caused by the pandemic, or any of the provisions in the American Rescue Plan—that the net financial position of multiemployer pensions would decline from a negative $65.2 billion in 2019 to an estimated negative $82.3 billion by 2029, or roughly $17.1 billion further into the negative over the next decade. Obviously the 2021 report will paint a clearer picture of where multiemployer pensions currently stand, but this may be a topic we will need to revisit before this downward trend can be corrected.

Healthcare and Pandemic-Specific Provisions

While most of the previously discussed items provide relief to working families suffering as a result of the pandemic, the American Rescue Plan also designates funds for getting Coronavirus under control. I won’t go through all the details, but here are some of the prominent healthcare provisions that stood out:

$7.5 billion in funding for the Centers for Disease Control and Prevention (CDC) to distribute Coronavirus vaccines

$5.2 billion for the Biomedical Advanced Research and Development Authority (BARDA) to acquire supplies and vaccines

$7.66 billion for a public health workers jobs program designed to employ roughly 100,000 healthcare professionals, according to Biden’s initial proposal

Federal assistance for nursing homes and other long-term care facilities, including federal “strike teams” who can be deployed to help contain outbreaks within facilities

COBRA subsidies reduce premium expenses for those continuing their previous employer’s insurance through provisions in the Consolidated Omnibus Reconciliation Act (COBRA)

$10 billion funding production of vaccines, medical equipment and supplies using the Defense Production Act, which was first used during the Korean War for producing military equipment and supplies

$10 billion for foreign aid in dealing with the pandemic, because like the Senate Summary mentions, “As long as the virus is spreading and mutating anywhere, it threatens Americans here at home.”

$7.6 billion for Community Health Centers, which more than doubles their funding

Again, Medicare for All would eliminate the need for Congressional intervention in many instances, such as the COBRA subsidization, and would likely be a more cost-effective solution to providing affordable healthcare. This relief package still helps people in the meantime, but we must continue striving for a better long-term solution like Medicare for All, lest we end up in a similar situation in the near future.

School Funding and Safe Reopening Assistance

Students, teachers and parents have had their routines disrupted for over a year now, but a return to some semblance of normalcy may be within reach if we continue to make progress. The American Rescue Plan provides assistance for schools to safely reopen, and for students themselves. According to the Senate Summary, “ARP provides over $125 billion for public K-12 schools to safely reopen schools for in-person learning, address learning loss, and support students as they work to recover from the long-term impacts of the pandemic.”

I am thankful that teachers’ unions have been on the forefront of advocating for their safety and the safety of their students, but now they also have additional help in this effort. Hopefully between the vaccinations and safer classrooms, teachers and students alike will be able to return to schools without risking their own lives and the health of their families as well.

Other Notable Provisions

Infrastructure spending, including broadband internet and transportation

Extended benefits for the disrupted airline industry, preserving tens of thousands of jobs, including those held by unionized flight attendants

Federal funding for the Department of Labor earmarked for such programs as:

Occupational Safety and Health Administration (OSHA)

Office of Workers’ Compensation Programs

Product and workplace safety program funding, protecting everyone from consumers, farmers, and meat processing plant workers, to healthcare professionals

Funding for government agencies to upgrade their aging I.T. equipment, allowing for more secure, reliable public services

State and local government funding, preventing harmful budget cuts and layoffs

Outreach programs to inform those who may qualify for relief

Oversight programs to ensure that funds are spent as intended

Although many items requested in President Biden’s initial proposal made it into the final bill, multiple provisions were unnecessarily reduced or cut altogether. While this relief stands to reduce poverty like the CARES Act did, much of the relief still either occurs once or otherwise has arbitrary cutoff dates, so the beneficial impact may be short lived unless structural changes can be passed soon. Ultimately, the American Rescue Plan does many things right, and the benefits overwhelmingly go to those lowest on the income spectrum.

Distributional Analysis of the American Rescue Plan

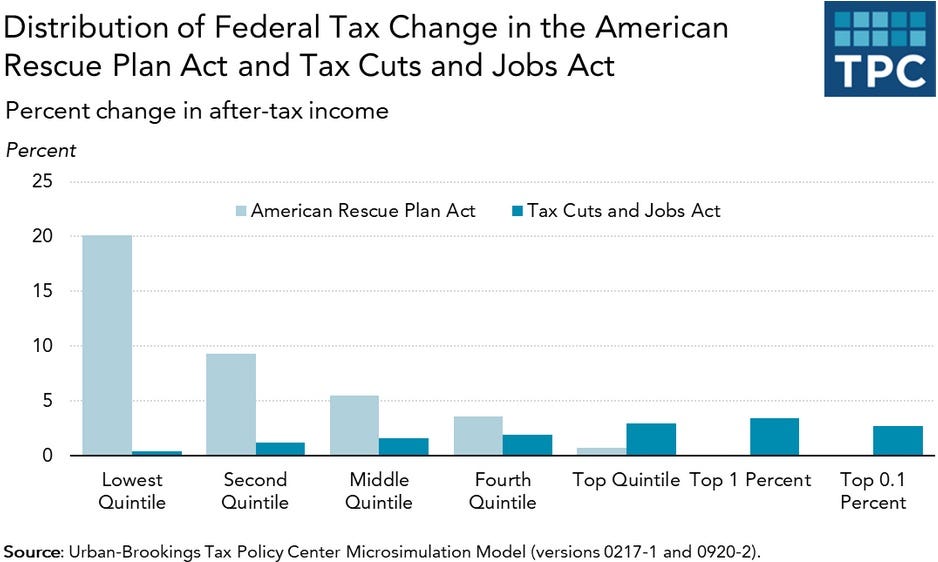

The Urban-Brookings Tax Policy Center conducted analysis on estimated changes in after-tax income due to the American Rescue Plan, or to whom the benefits would be distributed, essentially. They also performed similar analysis for the Trump tax cuts, which also cost roughly $1.9 trillion, and compared the two side by side. The results are staggering if not necessarily surprising. See the graph below showing the percent change in incomes from each policy, and look first at the various quintiles—or groups of 20% along the income spectrum—to see the stark difference between what Democrats and Republicans pass through reconciliation.

You can see that the lowest quintile received a roughly 20% increase in after-tax income from the American Rescue Plan, while you can hardly even see the bar representing the Trump tax cuts beside it. As incomes increase, the American Rescue Plan delivers smaller but still significant increases to most households. The Trump tax cuts, on the other hand, disproportionately cut taxes for the wealthy, with most benefits reaching the top 1% of all earners. But even the richest households were stratified within the Trump tax cuts, as you can see that the top 10% of the 1%—i.e., the top 0.1% of all earners—received most of the tax cuts delivered to the top 1%.

Again, not a single Republican voted for the American Rescue Plan; likewise, not a single Democrat voted for the Trump tax cuts. Both bills passed through the Senate via budget reconciliation and therefore only required a simple majority of 51 out of 100 votes to pass.

The American Rescue Plan is a great step in the right direction, moving us closer to a more just, equitable economy, but we still have a long way to go. If we can maintain the political momentum from this moment, and pave a path for additional legislation, we can continue to make necessary progress.

This Could Be a New Beginning in American Politics If We Maintain Momentum

Throughout this Coronavirus Relief and Economic Stimulus series, we’ve seen both the devastation that the pandemic has had on so many working families across the country, and we’ve seen how the government can step in to alleviate unnecessary suffering. If the government had done more to protect everyone throughout 2020, we might not have lost so many lives, jobs, and businesses in the process. Because we cannot undo the past, we must do our best moving forward, and the American Rescue Plan is a great first step, if not a perfect solution to every problem that led to this point.

Between all the different policies enacted to address the pandemic, including the $2.754 trillion appropriated in the CARES Act and related laws, the $0.9 trillion allocated for Coronavirus relief within the Omnibus Spending Bill passed in December 2020, and the $1.9 trillion American Rescue Plan Act, the U.S. government spent at least $5 trillion in total. By doing so, we learned that we lifted millions out of poverty, kept millions from falling into poverty, stimulated the economy, and could prove that the federal government can accomplish feats that no other entity can.

Regardless of the vast bipartisan popularity and overwhelming success of Coronavirus relief policies, Republican politicians still refuse to vote for beneficial legislation and seek only to obstruct. We still have a lot of work to do before such unnecessary suffering can be prevented from happening again, but if this marks the beginning of the structural changes we make rather than the end, then we can bring about lasting improvements for millions of people across the United States.

One relatively simple step we could take would be to make certain Coronavirus relief provisions permanent, or at least automatically kick in during economic downturns, rather than creating a Congressional crisis any time working families need rapid relief. The new Protect the Right to Organize (PRO) Act and $3 trillion infrastructure proposals also look like promising ways to maintain legislative momentum and deliver long-term change, but as with many of the provisions in the American Rescue Plan, their passage into law will undoubtedly depend upon how fervently the Democratic party will defend them against corporate Democrats and Republican detractors.

If we can continue to repeat past successes, advocate for transformative legislation addressing systemic issues, and ensure that our elected officials represent our interests, then we have a good chance at turning this tragedy around and creating a more just economy, a better world, and avoiding such unnecessary suffering in the future.

Thank you for reading my newsletter and taking the effort to learn about making the world a better place. I look forward to hearing your thoughts on how we can make progress towards a more just economy.

-JJ

Updated 6/27/2022 - Updated captions for images; added embedded Tweet with video of the infamous Synema thumbs-down vote; italicized signoff; fixed long dashes.

Updated 9/20/2021 - Removed date updated from top of the article

Updated 5/31/2021 - Added screenshots for Labor Day and Senate recess citations; added links throughout for readers’ convenience; added subscribe, donate, share and comment buttons.

Another well thought out newsletter. I have questions about the tax credits. Hopefully you will be able to find out more information about them.