Economic Progress Beset by Uncertainty as the U.S. Approaches 2022 Midterm Elections

Q3 2022 Job Growth, GDP Growth, Inflation, and Other Mixed Economic Signals

Midterm elections are right around the corner, but it’s hard to tell whether the economy is in good or bad shape these days.

With so many different economic indicators pointing in different directions—for instance, employment levels and GDP continue to show relatively strong signs of growth, while inflation remains uncomfortably high—it’s difficult to determine if the overall economy is moving in the right direction.

Let’s take a closer look at some of these indicators and try to make sense of these mixed economic signals.

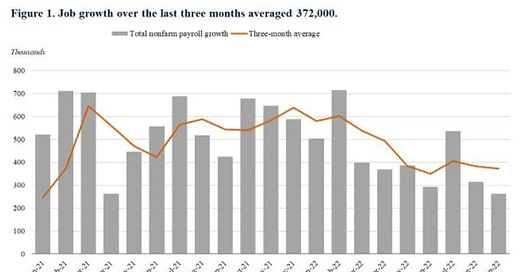

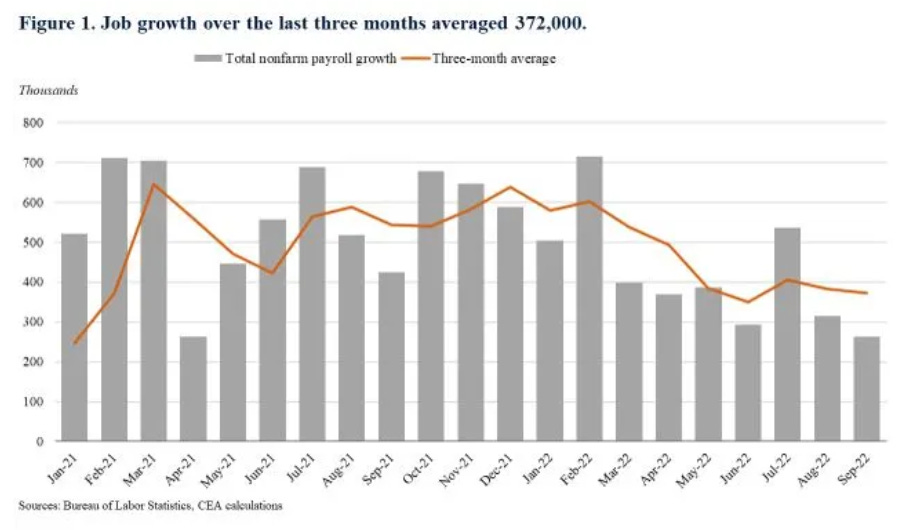

Q3 2022 Job Growth Averaged 372,000 per Month

Although job growth is beginning to decelerate, it remains robust. The graph below shows how July bolsters the Q3 2022 average growth rate, but most months since the beginning of 2021 have posted net job growth of at least 300,000 more jobs added than lost.

When we look at individual industries, we once again see some industries growing while others lost jobs. Leisure and hospitality added approximately 83,000 jobs more than it lost, but government jobs—driven primarily by losses in local government education jobs—lost around 25,000 more than it gained. The table below shows an overview of jobs added and lost in various industries throughout the U.S. economy.

Job growth rates were positive overall, with some causes for concern in the details; total economic output indicators—like gross domestic product (GDP)—tell a similar story.

GDP Growth Accelerated to 2.6% in Q3 2022

While real GDP growing at an annualized rate of 2.6% throughout the third quarter of 2022 is not the strongest cause for economic optimism, it certainly casts doubt on the “stagflation” narratives circulating earlier this year. The first half of 2022 showed shrinking levels of output, as you can see in the graph below, but many positive signs make it difficult to compare this inflationary period to the “stagflation” of the 1970s.

Still, not all signs point towards an economy moving in the right direction. Consumer spending, for instance, is beginning to decelerate. The chart below shows percentage changes in personal income, outlays—which is generally synonymous with “spending” in this context—and personal savings between March and September 2022.

Some of this slowing in consumer spending may be attributable to the Federal Reserve trying—misguidedly, in this writer’s opinion—to bring inflation down by raising interest rates in order to hinder consumers’ ability to demand goods and services. But before I address the Fed, let’s take a look first at inflation indicators.

Inflation Remains Uncomfortably High

Despite signs that inflation may be moderating throughout July and August, September results moved in the opposite direction. The Consumer Price Index shows an uptick of 0.4% throughout September 2022, after a relatively flat July and August, which results in an annualized rate of 8.2% overall. Energy and fuel prices are continuing to decline, however, which might soon provide relief for other categories of rising prices.

Core CPI inflation—price changes in items other than food and energy—is still approximately 6.6% for the year. The table below shows a breakdown of these and other categories since March.

The Fed’s preferred inflation metrics, Personal Consumption Expenditures or PCE data, show a similar trend. Headline PCE inflation sits at 6.2% while the core rate rose from 4.9% in August to 5.1% in September.

Despite this unfortunate news, there is evidence to suggest that some of the supply chain bottlenecks—which disproportionately contributed to these elevated levels of inflation—may be getting resolved.

There are once again mixed signals in these details, such as declining levels of overall consumer demand coupled with a shift away from purchasing goods back towards paying for services, but I remain hopeful that supply chains stabilizing will have positive a positive impact on the economy.

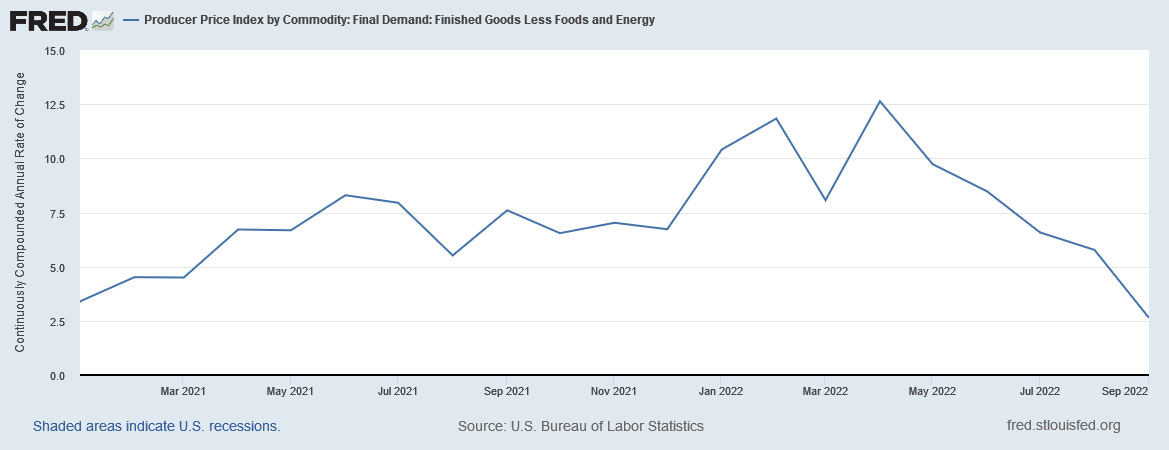

Although consumer prices moved in the wrong direction in September, producer prices are starting to get under control. The chart below shows fluctuations in the Producer Price Index, less those attributable to food and energy prices, since 2021.

Still, while these levels of inflation are undesirable, the Fed is apparently maintaining its current course of trying to reduce demand by increasing interest rates. Many experts, including former Fed economist Claudia Sahm, hope that central banks around the world reconsider this reckless strategy, but it’s already inflicting unnecessary harm on working families worldwide.

However, there is something that voters can do to help: prevent a repeat of the 2010 midterm elections.

Eligible Voters: Vote for Progress to Prevent Another Lost Decade

If you, or anyone you know, struggled in the wake of the 2007-2009 recession, much of that unnecessary suffering was inflicted by a gridlocked Congress following the 2010 midterm elections. Congressional Republicans cared more about blaming that suffering on the Democratic leadership than proposing alternative solutions themselves, and it’s their strategy this time around.

Don’t take my word for it; listen to Senator Mitch McConnell tell you what his priorities are:

In the House of Representatives, Chip Roy of Texas has a similar strategy:

While the Democratic leadership has certainly not been perfect, we are nonetheless making progress after this devastating pandemic recession. People are getting back to work; we’re investing in our infrastructure; we’re protecting and seeking to expand Social Security and Medicare; middle- and working-class families got tax breaks (instead of just the billionaires getting golden parachutes, as they did following the last recession); none of this progress would be possible under a divided Congress.

If you want “chaos and inability to get stuff done”, like Representative Chip Roy (R-TX) wants, then vote for Republicans and a divided Congress. If you want progress, vote for a progressive Democrat.

Thank you for reading my newsletter and taking the effort to learn about making the world a better place. I look forward to hearing your thoughts on how we can make progress towards a more just economy.

-JJ