A February Update on Jobs, Corruption, and Unionization

Revisions to 2021 job growth data, pandemic disruptions, inflation, corporate profits, supply chains, Congressional stock trading and more!

With so many important stories to cover—and, frankly, not enough time to discuss them all in the comprehensive manner some of my articles do—I wanted to put together a handful of brief updates on multiple topics I’m currently tracking.

BLS Jobs Report Revisions

On February 4, 2022, the Bureau of Labor Statistics released their first Employment Situation Summary examining job growth during 2022. This included not only surprisingly good news for January job growth—a net total of 467,000 jobs added to the U.S. economy—but also revised upward several months of 2021.

The table below shows a summary of changes to individual months’ job growth statistics, the total changes in nonfarm employment levels throughout the year, and reflects an overall smoother trend of job growth from month to month despite pandemic-related and other disruptions.

This resulted in the U.S. economy adding more than 6.6 million jobs throughout 2021, approximately 217,000 more than estimated last month. The chart below shows how this translates to more than 550,000 additional jobs on average every month of 2021, and 3-month averages hovering fairly close to this average throughout the year.

Similar revision processes occur annually as more information comes in, and you can read more details about the process in the latest jobs report. But 2021 was hardly a normal year, so volatility posed problems for the BLS and other analysts.

During an ongoing pandemic which has made seasonal adjustments and other data analysis particularly challenging, some months—like June and July being revised downward by a combined 807,000 jobs—serve as important reminders to avoid reading too much into a single month’s preliminary job growth data.

However, while some data has smoothed out over the past year, the White House Council of Economic Advisors noted a record number of health-related work absences in January:

In addition, 3.6 million workers did not work the entire week of January 9th-15th due to their own illness, injury, or medical problem, the highest level of health-related work absences on record (since 1976). Over 4 million workers who usually work full-time worked part-time in that week due to a health-related reason, also a series high.

The BLS also reported that 6 million workers were unable to work due to the pandemic during January, which is nearly double the 3.1 million workers in similar situations throughout December, and only 23.7% of those 6 million workers—approximately 1.4 million—received pay for hours not worked.

Although some metrics show signs of improvement, the COVID pandemic is still a massive source of disruption.

COVID Cases Decelerate, but Deaths and Disability Persist

As we enter the latter half of winter, daily COVID cases are, thankfully, continuing a downward trend, though they are coming down from dizzying heights. You can see in the CDC chart below that, regrettably, there were multiple days in which more than a million people tested positive for COVID-19.

While cases are decelerating, deaths—which tend to follow weeks after first becoming infected—are still occurring by the thousands every day.

We reached a grim milestone of more than 900,000 total deaths earlier this month. If we continue at this pace, the U.S. could surpass one million deaths by the end of 2022.

And if a person is fortunate enough to survive an infection, it does not guarantee that they will not suffer lasting consequences from COVID-19. Some estimates suggest that anywhere between 10 to 30 percent of people who become infected will suffer from debilitating “long COVID” symptoms, such as these U.C. Davis studies last year which found:

More than one in four COVID-19 patients develop long-haul symptoms lasting for months – even if they had mild cases, according to a handful of studies that have emerged recently.

Perhaps people will finally begin to take this seriously once it becomes clear that, in addition to public health consequences, these deaths and long-term symptoms will also take an economic toll. Like Katie Bach of the Brookings Institution told CBS News earlier this month:

"I don't believe we will take steps to deal with this crisis until we understand the full economic burden," Bach said. "Understanding the economic burden of long COVID is what is most likely to move the needle in getting people to take this seriously."

Indeed, our corporate oligarchs never seem to do allow anything to alter the status quo until something hits them in their pocketbooks. Speaking of which, I’ve also been keeping an eye on the degree to which corporate profits are exacerbating this period of heightened inflation.

Inflation, Corporate Profits, and the Supply Chain

The latest BLS Consumer Price Index News Release reports that, for the 12-month period ending in January 2022, overall price levels increased by 7.5%. In an increasingly global, interconnected, and interdependent economy, other countries are also seeing price levels increase.

However, the extent to which U.S. inflation exceeds what other countries are currently experiencing is a rather complex issue. While I might go into further details in future articles, I wanted to share some brief summaries of topics I’ve been researching lately.

I’ve mentioned reporting by The American Prospect in articles before, but they’ve outdone themselves in their latest series on the U.S. supply chain, and I encourage my readers to read it as well. The series begins with a great summary of How We Broke the Supply Chain, outlining how outsourcing, deregulation, just-in-time logistics, and other recent trends have left our supply chain vulnerable to virtually any disruptions.

Subsequent articles in the series go in depth about our ports, railroads, trucking, oceanic shipping, and warehouses have evolved over the decades. They also discuss consolidation, deregulation, and other instances of corporate greed in various industries, such as the meat packing and healthcare industries.

Others are also echoing the accusations of profiteering, including the Biden administration. Last year, the Biden administration issued a press briefing about Addressing Concentration in the Meat-Processing Industry to Lower Food Prices for American Families.

This was followed up last month with the announcement of several investments, including $1 billion worth of American Rescue Plan funds, being made towards increasing productive capacities and enabling small, independent processors to be more competitive.

There are also reports of corporate earnings calls involving CEOs boasting about their ability to use increasing prices across other industries as cover to increase their own company’s prices, despite soaring profits.

For instance, the CFO of 3M—one of the major manufacturers of N95 masks and other supplies—reportedly said that “The team has done a marvelous job in driving price.” during an earnings call with investors. There are similar reports of companies from several different industries, including Tyson Foods and Johnson & Johnson, whose CEOs see rising prices as an opportunity to turn the screws on working families and brag about it during earnings calls.

This is the inevitable outcome when monopolies and oligopolies have all the market power and consumers have virtually none.

With Ivy League and neoclassical macroeconomists blaming pandemic relief spending for inflation—while ignoring their own roles in deregulation, outsourcing and shipping jobs overseas, undermining antitrust enforcement, fostering industry consolidation and supply chain fragility—it reminds me of a quote from The Wealth of Nations by Adam Smith:

The rise of profit operates like compound interest. Our merchants and master-manufacturers complain much of the bad effects of high wages in raising the price, and thereby lessening the sale of their goods both at home and abroad. They say nothing concerning the bad effects of high profits. They are silent with regard to the pernicious effects of their own gains. They complain only of those of other people.

This is nothing new. Adam Smith noticed similar dynamics in 1776. Yet people all too frequently act as if inflation is some unavoidable curse that only some monetary policy rituals from the Federal Reserve can solve. I’m not arguing that corporate greed is the sole cause of rising prices, that supply chain disruptions are either, or even that monetary policy cannot help alleviate some inflationary pressures; I’m saying that we also need to address some fundamental flaws in our economy.

We need to pass the Build Back Better Act and build more homes, invest in green energy, in workers’ and students’ wellbeing, promote supply chain resiliency, and reduce the costs of education, healthcare, and housing.

We also need to rein in corporate greed, expand antitrust enforcement, and protect workers’ rights to collectively bargain for better working conditions. To President Biden’s credit, I think his appointees to the Federal Trade Commission, National Labor Relations Board, and the Antitrust Division of the Department of Justice are good starts, but we need to get Congress on board as well.

These are multifaceted problems that requires bold solutions to build up the institutions, resources, and solidarity that corporate greed has eroded throughout recent decades. Speaking of profiting at society’s collective expense, efforts to ban Congressmembers from owning and trading individual stocks is gaining momentum in both the House and Senate.

Banning Congressional Stock Trading Gains Momentum

Last year, I argued that Politicians, and Their Spouses, Should Not Be Allowed to Trade Individual Stocks while representing the public interest and having access to nonpublic information. I outlined how current regulations are insufficient for preventing corruption, how the accounting industry’s stock trading restrictions could serve as a guide for future legislation, and argued that current proposals—such as the Ban Conflicted Trading Act—could easily be improved with these insights in mind.

For instance, the Ban Conflicted Trading Act only covered members of Congress and certain staff members, as you can see in the screenshot of the Act’s text below.

Senator John Ossoff—who won an election just over a year ago in Georgia at least in part due to his opponent, former Senator Perdue, and his questionable stock trading while in office—recently introduced the Ban Congressional Stock Trading Act which expands the scope of covered individuals.

The screenshot below shows how it includes not just members of Congress, but also “…a spouse or dependent of the Member of Congress…” must either divest or place certain investments into a qualified blind trust.

To be clear, this is not a complete ban on Congressmembers being able to own investments. You can see in the screenshot below what investments are included in the ban and what exclusions, or exceptions to the rules, are made.

Diversified mutual funds, which invest in several companies across a variety of industries, and government retirement plans are excluded from any restrictions. Besides, placing any other investments into a qualified blind trust doesn’t mean they completely relinquish ownership of said investments. The members of Congress simply can’t buy and sell any individual stocks when they’re properly held in a blind trust; trustees make those decisions.

Even Speaker Pelosi has recently changed her tune on trading individual stocks, despite her tone-deaf comments last December. During a press conference in late January, Pelosi said, “If members [of Congress] want to do that, I’m okay with that.”

Representative Alexandria Ocasio-Cortez remarked that this is a “testament to the fact that public attention and pressure can move public policy from the bottom all the way to the top.” I agree and hope to see more public policy stemming from public opinion, rather than the opinions of corporate and wealthy campaign financiers.

Other Developments to Be Aware Of

Before I wrap up this February update, there are other topics I want to discuss in further detail in future articles, but want to at least bring them to your attention for now.

Warrantless Surveillance

Not all bills being introduced in Congress are great ideas supported by the public. The EARN IT Act would threaten free speech, cybersecurity, and give an already unaccountable, unconstitutional, surveillance apparatus more power.

If the fact that Senator Lindsay Graham is one of the bill’s main sponsors isn’t enough to convince you that it’s a bad idea, consider the implication that it would cause everything on the internet to be scanned while subverting end-to-end encryption. Weakening encryption, or possibly even rendering it useless, would put all sensitive information at risk.

What’s more is the ACLU just recently sounded alarms over recently declassified documents revealing a lawless, unaccountable CIA is already conducting clandestine surveillance programs targeting American citizens! Most people paying attention to these developments for the past couple decades knew this was the inevitable outcome of allowing the U.S.A. PATRIOT Act to pass and effectively throwing the Fourth Amendment of the Constitution out the window, but now we have yet another piece of concrete evidence.

If ever there was a time to not hand expanded powers over to an already lawless surveillance apparatus, it is now. I plan to cover government surveillance and surveillance capitalism in more detail throughout future articles, but because I want to end on a positive note, I will conclude with some optimism about growing unionization efforts across the country.

The Spirit of Striketober Lives On In February

I wanted to end on a positive note before wrapping this February edition of the Economic Justice and Progress Newsletter, and what would be a better way to do so than to celebrate some unionization victories?

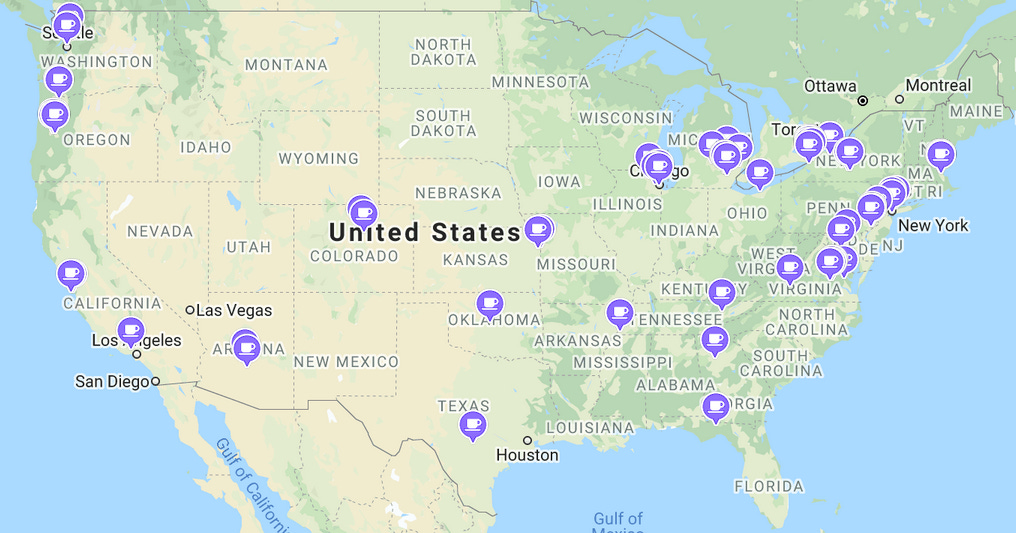

What began as a single Starbucks coffee shop unionizing in New York late last year has since spread across the United States. The map below shows locations that A More Perfect Union has tracked where Starbucks workers announced plans to unionize.

We still have a long way to go before we’re on a level playing field with the wealthy interests who seek to keep us divided, considering how the Supreme Court continues to treat unlimited campaign contributions as “free speech” and uphold partisan gerrymandering, but people across the United States are joining together in solidarity. Even Congressional staff workers are organizing to unionize!

Whether you work on the front lines during a pandemic, work in the trades and construct or maintain our country’s infrastructure, or you work in an office—even the highest office—you deserve to have a safe workplace and to earn a living wage while having time to spend with your loved ones. I remain convinced that an organized labor movement is the best way to progress towards a more just economy.

If you would like to share your thoughts on what a more just economy would look like for you and your family, or what other topics you would like me to cover in future articles, feel free to leave a comment below or respond directly to this email.

Thank you for reading my newsletter and taking the effort to learn about making the world a better place. I look forward to hearing your thoughts on how we can make progress towards a more just economy.

—JJ

Updated 6/27/2022 - Updated image captions